The Latest Shift in Mortgage Rates and Inflation: What You Need to Know

Market Outlook: Will the Bond Market Cheer a September Rate Cut?

When the Federal Reserve announces a rate cut this September, the real question is: will it truly move the needle on mortgage rates? For a significant drop in mortgage rates to materialize, we need more than just an announcement — we need tangible progress on inflation. Without that, the bond market, which heavily influences mortgage rates, may simply shrug and carry on with business as usual.

So, are markets already pricing in this cut? It's a possibility. Over the weekend, Fed Governor Michelle Bowman stoked the conversation, noting that recent job data supports her view of a 75-basis-point rate cut this year, distributed over three cuts. She highlighted key data points that are hard to ignore:

The unemployment rate is teetering just under 4.3%.

Over the past three months, job growth has been averaging just 35,000 jobs per month.

Revisions are expected for the June and July job reports.

Waiting too long to act could necessitate more drastic and potentially damaging measures down the line.

Fed Chair Search Heats Up

Meanwhile, whispers from The Wall Street Journal reveal that the hunt for the next Fed Chair is intensifying. Ten candidates are reportedly under consideration, with fresh names such as former St. Louis Fed President James Bullard and ex-George W. Bush adviser Marc Sumerlin entering the fray. Other contenders still in the mix include Kevin Warsh, Kevin Hassett, Christopher Waller, Adriana Kugler Miran, and even Michelle Bowman herself. Whether this is political maneuvering or a genuine shake-up remains to be seen. But one thing is clear: Jerome Powell’s time in office is coming to an end, and whoever replaces him will likely be a strong advocate for cutting rates.

CPI Inflation Preview

All eyes are on the July Consumer Price Index (CPI) report, one of the most influential data points for mortgage rates. Here’s what to expect:

Headline CPI: Expected to range between 0.16% and 0.20% (up from last year's 0.14%). Year-over-year, inflation could either hold steady at 2.7% or tick up slightly to 2.8%.

Core CPI: Projected at 0.24% to 0.30%, which is a bit higher than the headline number. This could push annual core inflation from 2.9% to 3.0%.

Shelter Costs: As always, shelter costs remain the most significant component of CPI. Last month saw a substantial dip, driven by a decrease in “lodging away from home.” If shelter costs remain in check, it could help keep overall inflation subdued.

This Week’s Key Events

OPEC Monthly Report – Tuesday

July CPI (Inflation) – Tuesday

July PPI (Producer Prices) – Thursday

July Retail Sales – Friday

University of Michigan Consumer Sentiment – Friday

Five Fed Speakers

This week is packed with data that will shape the bond market’s expectations. The cooler the numbers, the better the chances that a September Fed cut will translate into lower mortgage rates for homebuyers.

What It Means for Mortgage Rates

If the inflation reports come in weaker than expected, the bond market is likely to rally, which could drive mortgage rates lower ahead of the Fed’s meeting in September. This would be a welcome relief for potential buyers looking for more affordable rates as we head into the fall.

However, if the inflation data comes in hotter than anticipated, mortgage rates may remain stuck at current levels, or potentially even rise, until there’s clear evidence that inflation is on a consistent downward trajectory. This makes the upcoming CPI report a pivotal moment — it could set the tone for mortgage rates in the coming weeks.

For homebuyers, a September rate cut without a corresponding drop in inflation may not provide the relief you're hoping for. But if inflation cools and the Fed delivers a strong cut, we could be looking at the most significant drop in mortgage rates since early 2023.

The Consumer Price Index (CPI) is a vital indicator that tracks the average change in the prices consumers pay for everyday goods and services like food, housing, transportation, and medical care. It’s the Federal Reserve’s go-to report for gauging inflation, and by extension, a crucial signal for where interest rates — and mortgage rates — might head. Let’s keep a close eye on it.

The Great American Mortgage Company: A Vision for Privatization and Its Impact on the Future of Home Financing

The Trump administration is reigniting a plan from its first term to privatize Fannie Mae and Freddie Mac, the two massive mortgage institutions that have been under federal conservatorship since their $187 billion bailout in 2008. At the heart of this strategy is investor Bill Ackman, a major shareholder who has advocated for over a decade to merge Fannie Mae and Freddie Mac into a single entity, tentatively called the “Great American Mortgage Corporation.” The idea is to reduce costs, improve operational efficiency, and, ultimately, lower mortgage rates for consumers.

Imagine this: a potential initial public offering (IPO) that could value the combined company at $500 billion, positioning it as possibly the largest public offering in history. But the road to this monumental shift is far from straightforward. The U.S. Treasury still holds a hefty $340 billion in preferred shares, and ongoing debate centers around whether to convert or forgive part of this stake.

While the merger could streamline operations and reduce federal oversight, there are significant hurdles to overcome. Fannie Mae and Freddie Mac are both still short of required capital reserves by $33 billion and $162 billion, respectively. Even more critical, a recent Federal Reserve study warned that privatization could increase mortgage rates by 0.50% to 1.00% if investor risk premiums rise. Yet, the administration maintains that some form of government guarantee will remain intact, potentially mitigating these costs for borrowers.

Why is Privatization Being Proposed?

Streamlined Oversight: Combining Fannie Mae and Freddie Mac would simplify regulatory oversight, consolidating the current supervisory role of the Federal Housing Finance Agency (FHFA).

Unlocking Value: Privatization could inject $500 billion into the market, offering an opportunity to reduce the federal deficit and raise substantial capital.

Investor Support: Bill Ackman, a longtime investor in both entities, believes a merger could improve operational efficiency, boost market value, and create a more resilient mortgage system.

Could This Lower Mortgage Rates?

The fundamental question remains: can this merger lead to lower mortgage rates for consumers? The theory is that a single, privatized entity could:

Operate with more efficiency and lower overhead costs.

Access private capital and bring innovation to the market.

Pass on savings to borrowers through lower mortgage spreads.

Potentially reduce the long-term cost of government guarantees.

Ackman believes this streamlining could translate into lower rates, but there are dissenting voices. Critics warn that if the government reduces its explicit backing, investors may demand higher returns, leading to higher mortgage rates. And let's face it, in an environment of inflationary pressure and market volatility, would anyone be surprised if investors were to push for a premium on perceived risk?

The Road Ahead: Challenges and Risks

Privatization is not a simple process, and its success hinges on several critical factors, both political and regulatory. The U.S. Treasury’s preferred shares need to be resolved, and market stability must be maintained throughout the transition. But even more challenging is gaining bipartisan support for such a radical restructuring of the mortgage landscape.

The plan to create a singular, more efficient mortgage giant holds promise, but its impact on mortgage rates will be directly tied to how much government support is retained in the new structure.

Risks for Investors

Loss of Government Support: Without the federal guarantee, mortgage-backed securities may be seen as riskier, leading to higher required yields and price fluctuations.

Political Uncertainty: The structure could shift dramatically with future administrations, potentially creating long-term volatility.

IPO Valuation Risk: If the market questions the profitability or stability of the new company, the IPO could fail to meet expectations.

Transition Disruption: Integrating the systems and cultures of two massive organizations could cause short-term operational setbacks.

Interest Rate Sensitivity: Rising rates or stubborn inflation could depress mortgage demand and reduce business volume for the merged entity.

Risks for Homebuyers

Higher Mortgage Rates: If investors demand higher returns, mortgage rates could rise despite the goal of lower costs.

Tighter Lending Standards: A privatized, profit-driven mortgage giant might become more selective in its lending criteria, making it more difficult for some borrowers to secure a loan.

Less Support for Affordable Housing: Without strong federal mandates, programs designed to help first-time homebuyers or lower-income households may face cuts.

Market Instability: A rough transition could lead to temporary disruptions in the availability and pricing of mortgage loans.

Regional Disparities: Profit-driven motives could shift focus away from less profitable regions, limiting loan options in rural or underserved areas.

Looking Ahead: A Transformative Shift or a Gamble?

The merger of Fannie Mae and Freddie Mac into a singular entity, if executed well, could streamline operations and bring down costs, benefiting consumers with lower mortgage rates. However, the transition carries significant risks: mortgage rates could rise if government guarantees are reduced, lending standards could tighten, and affordable housing programs might lose their emphasis. This proposed transformation is a monumental shift in the mortgage market, and the outcome remains uncertain.

Ultimately, the hope is that the privatization of these institutions could lead to reduced costs and a more efficient mortgage system. But as with any significant change, the devil will be in the details. Buyers, investors, and policymakers alike must keep a watchful eye on how this merger evolves and what it means for the future of home financing.

Homebuying Affordability: A Glimmer of Relief Amid Persistent Challenges

While the income required to purchase a median-priced home in the U.S. has remained relatively stable from last year, some of the country's most expensive housing markets are finally seeing a slight reprieve. Oakland, CA, for instance, led the way with the largest drop in required income, driven by falling home prices. Yet, even as affordability improves in select areas, the challenges remain steep, particularly in high-cost markets like California.

Key Insights from the Redfin Report:

National Overview: To afford the median-priced U.S. home, buyers now need an annual income of $112,131—up just 0.5% from the previous year.

Affordability Relief in Some Markets: The income required to buy a typical home has decreased in 11 of the nation’s 50 largest metro areas, signaling slight relief for homebuyers in these regions.

Oakland’s Improvement: In Oakland, CA, the required income dropped by 4.6% year-over-year to $244,073, marking the most significant decline among major metros.

High Costs Persist in Oakland: Despite the drop, Oakland remains one of the nation’s most expensive markets, with costs still far above the national average.

Buyer Negotiating Power: In markets like Phoenix, buyers are flexing more leverage, often securing $10,000–$15,000 in seller-paid closing costs.

Longer Time on Market: Homes that are not in top condition or priced competitively are lingering longer on the market, leading sellers to offer concessions to close deals.

Diminishing Premiums for Features: Buyers are focusing on affordability, leading to less value being placed on features like landscaped backyards and pools, which once commanded a premium.

The Affordability Gap: Still Widening, but Showing Some Improvement

Despite some localized declines in home prices, the affordability gap remains a challenge. Only about one-third of U.S. listings are affordable to the typical household—though that’s a slight improvement from last year. This highlights the ongoing difficulty for buyers, especially in high-cost markets like California, where incomes required to afford a median-priced home remain sky-high.

In cities like Los Angeles, San Francisco, and San Jose, homebuyers still face steep income requirements. For example, in Los Angeles, the required income is $234,619, while in San Francisco, it’s $393,443, and in San Jose, it’s a staggering $413,100. These figures continue to make these markets some of the least affordable in the nation. Sacramento, while more affordable compared to its coastal counterparts, still demands an income of about $151,700, making it one of the pricier markets in California.

What Does This Mean for Homebuyers?

While affordability challenges persist, there’s a growing opportunity for buyers to negotiate better deals. In slower-moving markets like Phoenix, buyers are gaining an edge, with many securing substantial seller-paid closing costs and having more flexibility to choose homes that fit their budget.

The market is evolving, and buyers are becoming more strategic. Homes that are priced too high or are not in top condition are sitting longer, motivating sellers to offer incentives. For buyers, this means more opportunity to secure favorable terms in their purchase.

Let’s Connect and Create a Plan

Navigating the complexities of today’s housing market can feel daunting, but you might be closer to homeownership than you think. I can help you map out a personalized plan, explore financing options, and identify any assistance programs you may qualify for. Let’s connect and start turning your homeownership goals into reality.

Stuck in Limbo: Commercial Real Estate Prices Frozen as Market Awaits Rate Relief

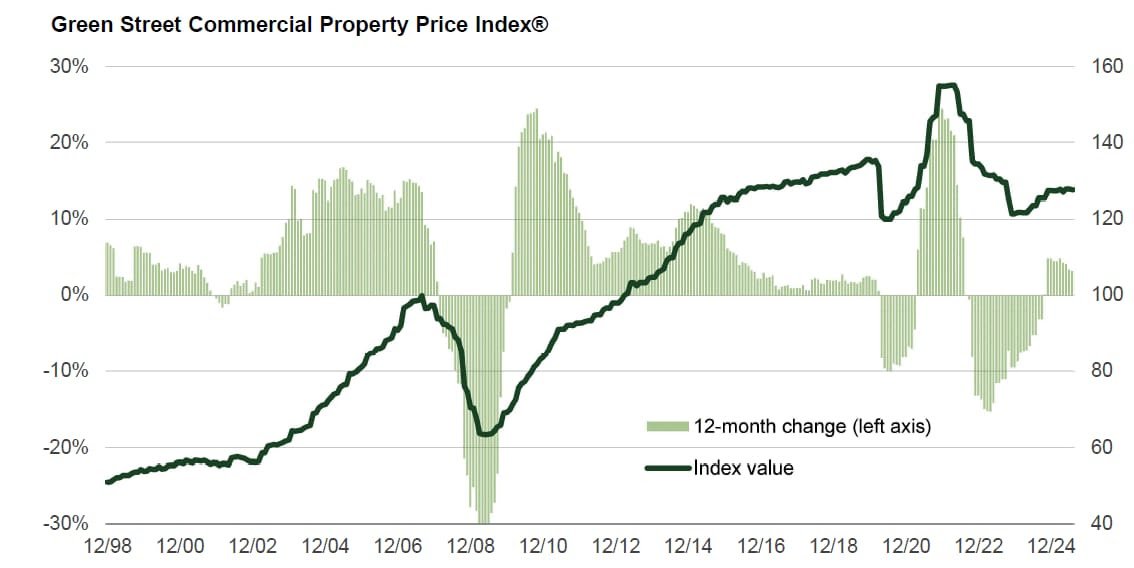

Commercial real estate (CRE) prices are caught in a state of inertia, stuck approximately 18% below their 2022 peak and showing little movement. With deals scarce and financing costs high, the market is waiting—waiting for the elusive rate relief that could break the current freeze.

The Numbers Don’t Lie:

Green Street’s Commercial Property Price Index only slipped by 0.1% in July, marking a modest 3.2% year-over-year increase. However, the reality is that commercial property values are still nearly 18% below their 2022 highs. Office values have plunged by 37%, while more stable sectors like strip retail and manufactured home parks have held steady, albeit with light trading.

What’s Driving the Standstill?

The primary culprit behind this stasis is the high interest rates and the costly borrowing environment. Transactions are stifled as buyers and sellers alike grapple with the financial burden of elevated borrowing costs. Sellers, for the most part, are refusing to accept significant discounts, choosing instead to wait out the turbulence. This has created a "shadow freeze"—where liquidity, not traditional supply and demand, is dictating market dynamics.

A Complete Price Reset Still Uncertain

This market inertia is preventing a full reset of CRE prices. The lack of distressed owners means forced sales are still rare, and there’s no clear indication of where values would settle if a wave of forced sales were to flood the market. Experts suggest that the market will remain in this limbo state until either interest rates drop or an external shock pushes more assets onto the market.

What to Watch for:

There’s growing anticipation in the market that the Federal Reserve may cut rates in September—potentially pulling the trigger a few months earlier than expected. J.P. Morgan has forecast a 25 basis point cut, prompted by softer jobs data and shifts in the political landscape at the central bank. With a 90% probability of this rate move, according to CME FedWatch, the market is watching closely to see if this will bring the relief needed to break the freeze.

The Big Picture:

CRE valuations are trapped—supported by patient owners on the floor, but capped by high borrowing costs at the ceiling. Until rates begin to fall, or until an unexpected catalyst forces more assets into the market, the commercial real estate market is likely to remain in this frozen state.